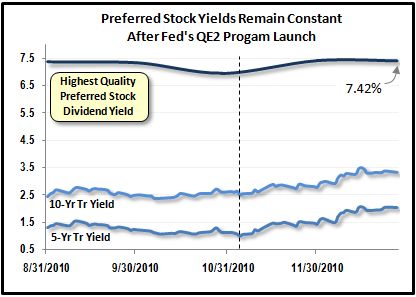

Holding at 7.42%, the average annual dividend yield being paid by the highest quality preferred stocks has remained stable since the Fed’s Quantitative Easing (QE2) program was announced on November 2, 2010. After two months, the initial results of QE2 show that while demand for government-issued fixed-income securities has fallen, the attraction of the highest quality preferred stocks has remained unaffected by the program.

Under QE2 the Fed is purchasing $600 billion in treasury bonds from its member banks. 86 percent of the Fed’s purchases, which began on November 12, 2010, are for treasuries with maturities between 2.5 years and 10 years. That’s an important timeframe for preferred stock investors since most preferred stocks have a five-year call provision. One of the primary goals of QE2 is to increase employment. As explained in the December 2010 issue of the CDx3 Newsletter, the sequence of events needed to motivate companies to hire more workers is a lengthy one. And the initial results over the last two months have not been what the Fed was expecting.

One of the primary goals of QE2 is to increase employment. As explained in the December 2010 issue of the CDx3 Newsletter, the sequence of events needed to motivate companies to hire more workers is a lengthy one. And the initial results over the last two months have not been what the Fed was expecting.

The idea is that by pulling $600 billion of treasury bonds out of the market, investors will pay more to get their hands on them, thereby increasing the market price of these government bonds. Since paying a higher price lowers the investor’s return (their “yield”), the effectiveness of the program’s first stages can be directly measured by watching for decreases in the yield of treasuries with durations less than 10 years.

By pushing yields down, the theory goes, companies will be able to raise their own capital (by issuing new high quality preferred stocks and bonds) at commensurately lower rates, saving a bunch of money with which they will hire more workers.

But that assumes that companies have enough confidence in future demand for their products and services to want to expand their businesses now. At this point, economic recovery is more about confidence than it is about corporate cost savings.

As shown on this chart, rather than decreasing, the yield on 5-year and 10-year treasuries has been increasing since the Fed made its first purchases on November 12, 2010 indicating that prices (demand) for government-issued securities have been falling, not rising.

At the same time, the yield being offered by the highest quality preferred stocks (top line) has not changed, indicating that market prices for these fixed-income securities have held steady despite the price degradation realized by treasury bonds of similar duration.

The falling yields that the Fed was expecting QE2 to produce have yet to materialize. While this has unfortunate implications for the employment picture, a stable 7.42% offered by the highest quality preferred stocks is welcomed news for preferred stock investors.

Many Happy Returns.

Wednesday, December 29, 2010

Preferred Stock Investors Ignore Fed's QE2

Posted by

Doug K. Le Du, Author of Preferred Stock Investing

at

3:28 PM